[Editorial] Conditions that have been converted into credit loans of the first financial sector of the company employee’s “traffic-versus-return” system

[Editorial] Conditions that have been converted into credit loans of the first financial sector of the company employee’s “traffic-versus-return” system

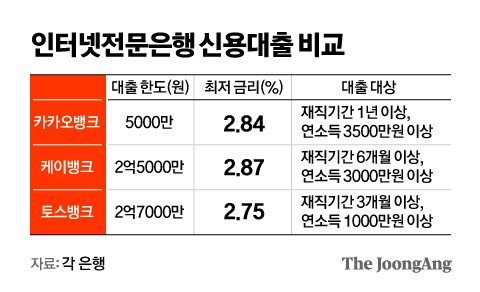

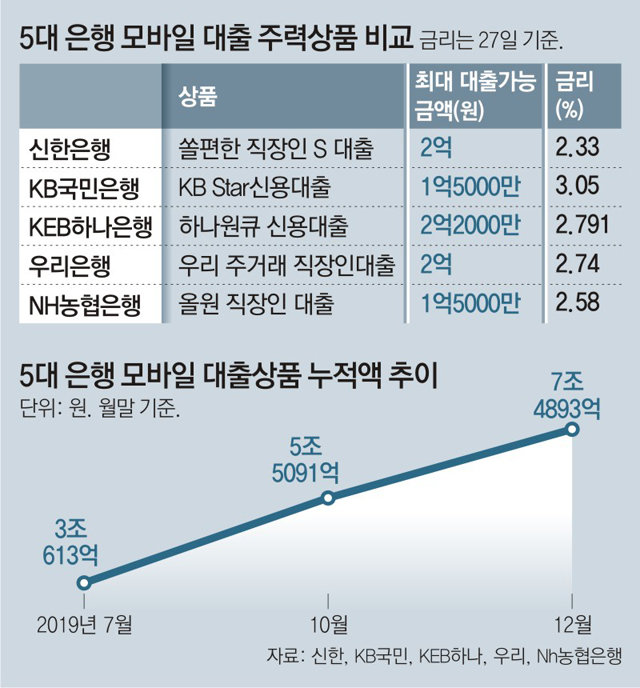

According to a recent survey of indicators over the past two years, including mortgage loans, more than 6 million cases have been delayed due to overdue payments. It is said that more than 300,000 households among those who already run their own business use more than 70% of their income to repay loan interest. The number DSR, also known as the debt repayment ratio, continues to rise, which has a significant impact on loans received when purchasing homes as interest rates continue to rise in the U.S. for a long time. So today, I learned how to safely receive one of the large conversion loans for office workers, “Tongdae Conversion,” without any fees or deceiving them.It was necessary to know the financial advantages of refund loans and what they were like, one of the refund loans available as a basic understanding priority office worker. Literally, it means to combine debts previously divided into various financial companies and then take out loans again based on improved credit scores, aiming to set the proportion of the primary financial sector higher than annual income. Most people say they prefer this method to reduce the burden of loan repayments and reduce financial costs by cleaning up non-performing loans. In order to improve the probability of success, consulting was needed to reduce various uncertainties and find a stable way.The funding strategy for commercial banks says that in order to create a more effective debt situation, the current situation and conditions of the borrower must be properly matched. First of all, only workers who subscribed to medical services were eligible, and the annual salary had to be calculated based on the salary charged with income tax for a certain period of time. It is said that the larger the amount used in the second financial sector, the more effective it is based on the remaining debt. The most important purpose was to secure funds as much as possible using the first financial sector, so the higher the interest rate on existing debts, the greater the benefits the applicant would receive. If the following three conditions that I summarized were met, I could be considered an object. Based on the company you are currently working for, there should have been no credit delinquency information such as delinquency except that you have worked for more than 10 months and the debt ratio is within 200%.The debt ratio, which varies depending on the size of the workplace, is relatively easy to borrow more money from banks if you are in a large workplace like a large company or public institution. The reason why we could do this was that there are products that can use or benefit from loans specially agreed with financial companies. However, it was true that the 40% DSR limit should be kept in mind, and at the same time, if an individual owns real estate such as apartments and villas, more options will be given, increasing the possibility of office workers’ repayment loans. Since there are various options, it is important to choose appropriate financial products, and careful attention was needed to carefully prepare the documents necessary for full-scale screening.As a way to handle it directly without incurring costs, some of the ways office workers can receive refinancing loans are using a government-supported system. Since it applies only to those who receive low income and annual salary, new hope spores and sunshine loans can be used sequentially for less than 45 million won, so those with short working periods can choose. There is a commission for a full loan, but of course you had to be careful because there could be fraud using it. On the other hand, financial products provided by the government are mainly guaranteed, and only the guaranteed amount is deducted and deposited, so I was able to choose the conditions that were advantageous to me.The overall process to improve creditworthiness starts with checking the rising credit score after repaying the remaining loans as a way to proceed with the loan. I will join two credit rating agencies with public trust, one of which is Nice Ji-Kimi and the other is an all-credit created by the Korea Federation of Banks. If you submit the payment details of the Korea Health Insurance Corporation and telecommunication expenses to these evaluation companies, you could raise your credit score slightly through the mobile app. In addition, through the simulation process, we had to check the information applied after the outbreak of a major disease. I was able to receive a decision to return the payment for the first time when there was no abnormality in the salary details recognized by the banking sector after receiving the related documents. After receiving guidance on the procedures to be carried out in the counseling process first, I visited the area and paid back the remaining principal, and after about 10 business days, I was able to change it to a new debt.We will examine the case system that has relieved the economic burden of high interest rates through the example of loan repayment by office workers. He was working at a local industrial complex, but he had a hard time due to high interest rates due to losses in mortgage loans and stock investment when purchasing a house. Among savings banks and credit card loans in the system, it was difficult to raise funds necessary for daily life as interest rates were continuously lost for nearly a year while using high interest rates of more than 15%. I checked the additional limit through the app, but I started looking into it because I felt that simple loan execution was meaningless. It took about three weeks to come up with an optimal counter-loan plan after carefully identifying the financial situation, but it was changed to interest about 50% cheaper than the previous payment. As a result, the credit score has also risen by about three levels. I heard that many companies I met through Internet search offer unfair contract conditions, but fortunately, I was able to get satisfactory results from each other.

According to a recent survey of indicators over the past two years, including mortgage loans, more than 6 million cases have been delayed due to overdue payments. It is said that more than 300,000 households among those who already run their own business use more than 70% of their income to repay loan interest. The number DSR, also known as the debt repayment ratio, continues to rise, which has a significant impact on loans received when purchasing homes as interest rates continue to rise in the U.S. for a long time. So today, I learned how to safely receive one of the large conversion loans for office workers, “Tongdae Conversion,” without any fees or deceiving them.It was necessary to know the financial advantages of refund loans and what they were like, one of the refund loans available as a basic understanding priority office worker. Literally, it means to combine debts previously divided into various financial companies and then take out loans again based on improved credit scores, aiming to set the proportion of the primary financial sector higher than annual income. Most people say they prefer this method to reduce the burden of loan repayments and reduce financial costs by cleaning up non-performing loans. In order to improve the probability of success, consulting was needed to reduce various uncertainties and find a stable way.The funding strategy for commercial banks says that in order to create a more effective debt situation, the current situation and conditions of the borrower must be properly matched. First of all, only workers who subscribed to medical services were eligible, and the annual salary had to be calculated based on the salary charged with income tax for a certain period of time. It is said that the larger the amount used in the second financial sector, the more effective it is based on the remaining debt. The most important purpose was to secure funds as much as possible using the first financial sector, so the higher the interest rate on existing debts, the greater the benefits the applicant would receive. If the following three conditions that I summarized were met, I could be considered an object. Based on the company you are currently working for, there should have been no credit delinquency information such as delinquency except that you have worked for more than 10 months and the debt ratio is within 200%.The debt ratio, which varies depending on the size of the workplace, is relatively easy to borrow more money from banks if you are in a large workplace like a large company or public institution. The reason why we could do this was that there are products that can use or benefit from loans specially agreed with financial companies. However, it was true that the 40% DSR limit should be kept in mind, and at the same time, if an individual owns real estate such as apartments and villas, more options will be given, increasing the possibility of office workers’ repayment loans. Since there are various options, it is important to choose appropriate financial products, and careful attention was needed to carefully prepare the documents necessary for full-scale screening.As a way to handle it directly without incurring costs, some of the ways office workers can receive refinancing loans are using a government-supported system. Since it applies only to those who receive low income and annual salary, new hope spores and sunshine loans can be used sequentially for less than 45 million won, so those with short working periods can choose. There is a commission for a full loan, but of course you had to be careful because there could be fraud using it. On the other hand, financial products provided by the government are mainly guaranteed, and only the guaranteed amount is deducted and deposited, so I was able to choose the conditions that were advantageous to me.The overall process to improve creditworthiness starts with checking the rising credit score after repaying the remaining loans as a way to proceed with the loan. I will join two credit rating agencies with public trust, one of which is Nice Ji-Kimi and the other is an all-credit created by the Korea Federation of Banks. If you submit the payment details of the Korea Health Insurance Corporation and telecommunication expenses to these evaluation companies, you could raise your credit score slightly through the mobile app. In addition, through the simulation process, we had to check the information applied after the outbreak of a major disease. I was able to receive a decision to return the payment for the first time when there was no abnormality in the salary details recognized by the banking sector after receiving the related documents. After receiving guidance on the procedures to be carried out in the counseling process first, I visited the area and paid back the remaining principal, and after about 10 business days, I was able to change it to a new debt.We will examine the case system that has relieved the economic burden of high interest rates through the example of loan repayment by office workers. He was working at a local industrial complex, but he had a hard time due to high interest rates due to losses in mortgage loans and stock investment when purchasing a house. Among savings banks and credit card loans in the system, it was difficult to raise funds necessary for daily life as interest rates were continuously lost for nearly a year while using high interest rates of more than 15%. I checked the additional limit through the app, but I started looking into it because I felt that simple loan execution was meaningless. It took about three weeks to come up with an optimal counter-loan plan after carefully identifying the financial situation, but it was changed to interest about 50% cheaper than the previous payment. As a result, the credit score has also risen by about three levels. I heard that many companies I met through Internet search offer unfair contract conditions, but fortunately, I was able to get satisfactory results from each other.

Previous image Next image

Previous image Next image

Previous image Next image